The eye opener in the appended link is that a major part of the Employers contribution goes towards the EPS. The form for the same can be downloaded from Download Application to obtain a certificate of EPF withdrawal for the house flat or construction of property.

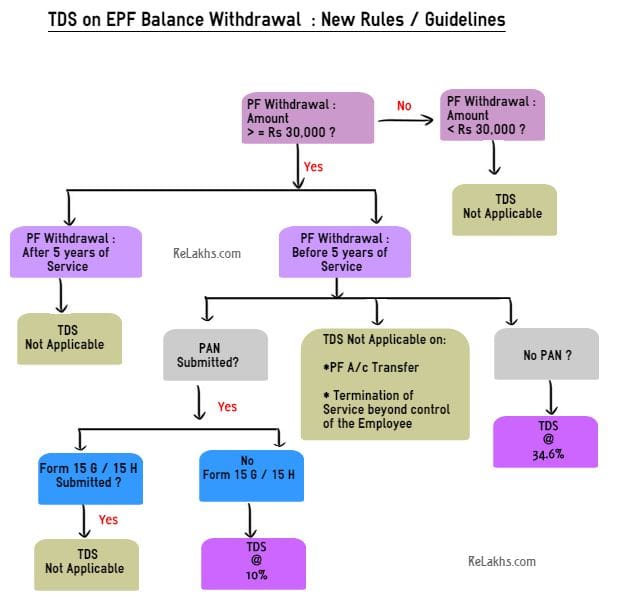

Epf Withdrawals New Rules Provisions Related To Tds

It had given 875 per cent rate of interest in 2013-14 as well as 2014-15 higher than the 85 per cent for 2012-13.

. KWSP - EPF contribution rates. The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. However the Employees Provident Fund Organization EPFO is set to launch an online facility for provident fund withdrawal by March 2016 since the Supreme Court extended Aadhaar card usage for government.

If there is a backdated contributions for April 2015. According to an official source the government will tax interest income on non-government employees portion of PF contributions over Rs25 lakh in a fiscal year at the individuals slab rate in the same year beginning in FY22. 12 of BASIC DA.

News About EPF contribution. EPF is a mandatory savings scheme under the Employees Provident Funds and Miscellaneous Provisions Act 1952. EPF Dividend Rate.

Along with the EPF Composite Claim Form you have to request EPFO Commissioner to issue the certificate in relation to the last 3 months EPF contribution and also the balance as of today. The DOE for Employer A has been updated just two days back wasnt mentioned before there was never an issue with the details pertaining to Employer B. Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550.

TDS Tax Deducted at Source is applicable on pre-mature EPF Employees Provident Fund withdrawals of Rs 50000 or more with effective from June 1st 2015. For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. EPF contribution for both employee and employer is calculated on the basis of your BASICDA ie.

It was 880 in 2015-16. This amount BASIC DA is capped at INR 15000. You are actually allowed to withdraw legally only if it has been more than two months that you are out of work.

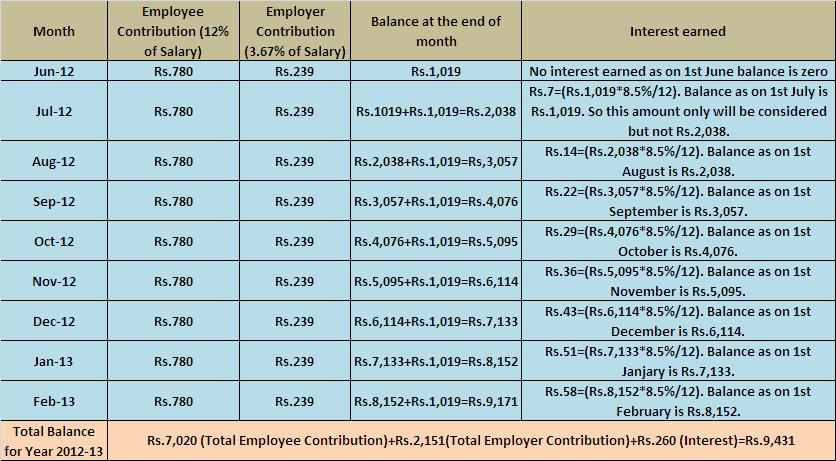

As per the Employee Provident Fund rules the employer contributions are payable on maximum wage ceiling of 15000. Considering the current EPF contribution rate to be 85 the monthly interest on EPF would be- Now assuming that the employee joined the organization on 1 April 2019 his contributions to his EPF account would be calculated from the financial year 2019 2020. PF contributions above Rs25 lakh to be taxed annually from FY22.

Employee Provident Fund EPF Interest Rate 2013-14. Your employers contribution to your EPF is also tax-free. Hike in EPF Interest Rates 2018-19.

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. Of Trustee is considered as the apex decision-making body of Employees Provident Fund Organization which decides on Employees Provident Fund interest rate whereas the finance ministry is merely expected to approve these rates as a matter of protocol. Get to know all about EPF interest rate for FY 2021 - 22.

The interest earned on the EPF Account balance every year is tax-free. Employee Provident Fund EPF Interest Rate 2014-15. How to calculate EPF EPF contribution important points to consider.

Also EPF withdrawals are liable to income tax if withdrawn before five years of service. Before that I worked with Employer A from 03032014 to 01102015. Also as on December 2015 you cannot withdraw your PF money through any online facility in that you will have to meet your ex-employer.

To pay contribution on higher wages a joint request from Employee and employer is required Para 266 of EPF Scheme. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. Above 15000 by submitting a joint request from Employee and employer as required in Para 266 of EPF Scheme.

You should have completed a minimum of 7 years in service. In other words if your BASIC DA exceeds INR 15000 the maximum EPF contribution will not exceed INR 1250. Employee Provident Fund EPF Interest Rate 2015-16.

Contributions for a particular month will be eligible for dividend based on the last day of the contribution month until 31 December 2021. The following conditions need to be met for the withdrawal. EPF interest rate.

And the best part is that the money. You can withdraw up to 50 of the funds for your your siblings or your childs wedding. No mandatory contribution from employer.

In such case employer has to pay administrative charges on the higher wages wages above 15000-. The maximum PF withdrawal limit in this case is 50 of your share of contribution to PF. The rate of interest was slightly higher at 88 per cent in 2015-16.

Employees Provident Fund- Contribution Rate. A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952. The rate of interest was 825 per cent in 2011-12.

However the contribution can also be done on higher wages ie. The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952.

Latest 2014 2015 Sss Contribution Table For Employers And Employees Employment Contribution Sss

How Epf Employees Provident Fund Interest Is Calculated

Govt Reduces Pf Administrative Charges Effective From Jan 2015 Sap Blogs

Govt Reduces Pf Administrative Charges Effective From Jan 2015 Sap Blogs

Provident Fund Pf Withdrawal Process Fund Block Lettering Online Jobs

Govt Reduces Pf Administrative Charges Effective From Jan 2015 Sap Blogs

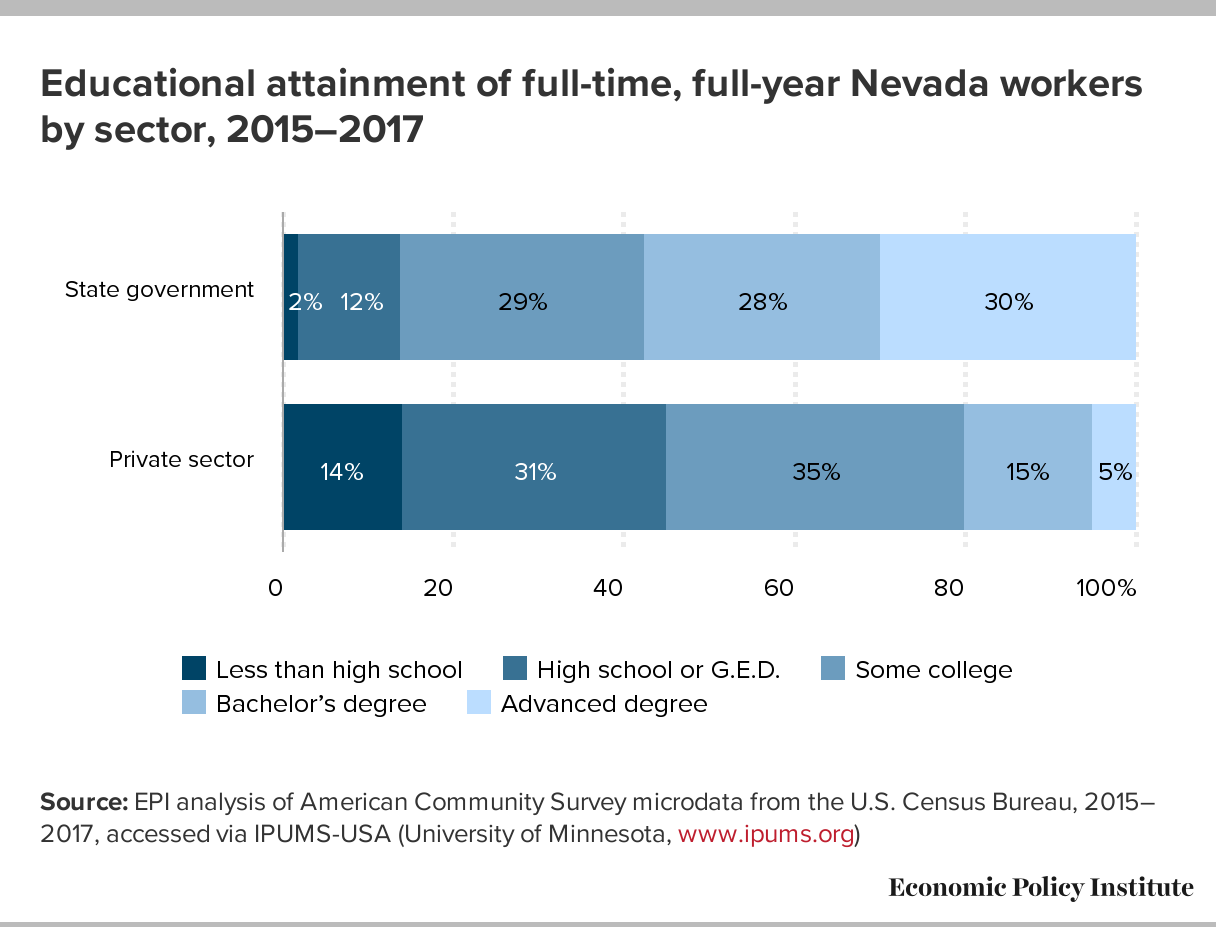

Nevada State Employee Fact Sheet Economic Policy Institute

Tax Saving Strategies For Latecomers Savings Strategy Saving Tax

Epf A C Interest Calculation Components Example

Tds Applicability And Rates Tax Deducted At Source Part 2 Tax Deducted At Source Rate Tax

Budget Impact On Msme Budgeting Helping People Encouragement

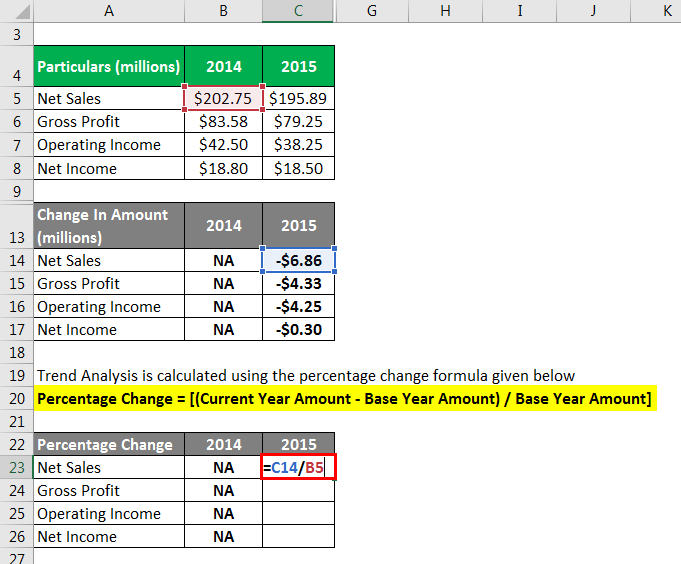

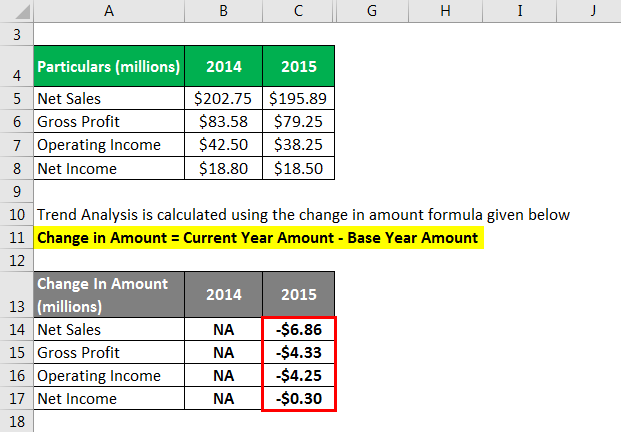

Trend Analysis Formula Calculator Example With Excel Template

Income Tax Ppt Revised Income Income Tax Tax

Growth In Epf Subscriptions And Scale Of Operations Over The Years As Download Scientific Diagram

Trend Analysis Formula Calculator Example With Excel Template

Sss Contribution Table 2015 Contribution Health And Fitness Magazine Sss

Pin On Take Training Make Your Career

How To View Epf Passbook And Track Contributions Interest Transfer Withdrawal

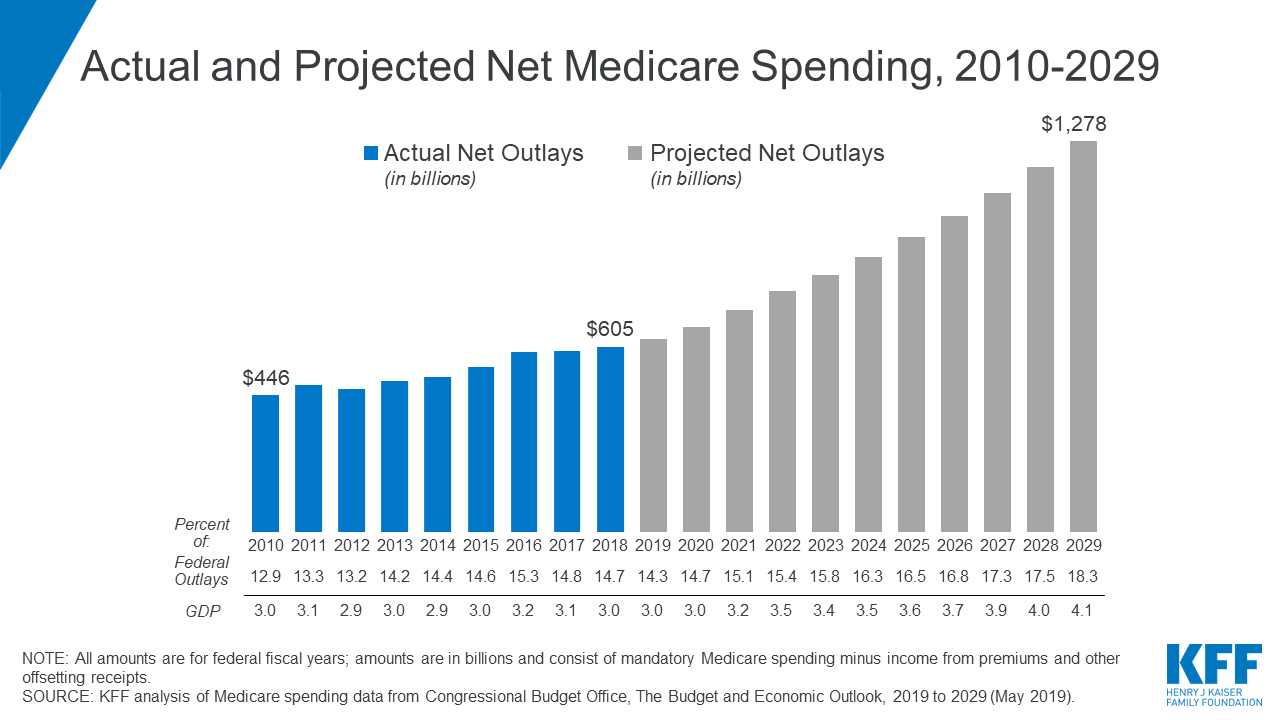

The Facts On Medicare Spending And Financing Kff